Accounting for Your First ESPP Reset or Rollover

For many companies’ accounting teams, this year’s market volatility has put employee stock purchase plans (ESPPs) in the limelight.

Recent years have seen a resurgence of ESPPs as a critical component of total rewards packages, and with good reason. ESPPs offer the opportunity to build or reinforce an ownership culture while offering a cost-effective alternative (or addition) to broad-based equity grants. They can be structured to provide employees with both a guaranteed return on investment and a potential windfall when the price appreciates.

Combined, these factors have made ESPPs a powerful tool to attract and retain talent amidst the strongest job market in decades. As a result, more companies are offering ESPPs that are as competitive as possible.

These lucrative plans are entirely win-win in a booming market, but what happens when the market drops? The short answer is that employees are still well taken care of—but certain accounting nuances can arise, especially for plans with a reset or rollover feature. In this article, we’ll recap some of the more complex scenarios that these features give rise to in a market downturn, then examine the accounting framework’s implications for expense and EPS dilution.

Accounting for Resets

Resets and rollovers apply only to certain ESPPs that have multiple purchase periods within a longer offering period. They’re triggered when a subsequent offering price is lower than the existing offering’s price.

In a reset, that situation causes the current active purchase to be made, then the lookback price for future purchases are reset to the now-lower price as of the new purchase period. That makes them very valuable to employees during periods of economic distress as they get access to the lowest purchase price to reap the maximum benefit. However, this treatment comes with additional layers of accounting complexity and cost.

When a reset occurs, ASC 718 directs us to apply a modification accounting framework for the remaining purchases. The reduction in the lookback price creates value in two distinct ways to consider:

- This reduced price boosts the value of the remaining shares to be purchased—effectively like lowering the strike price on an option—resulting in incremental cost under the ASC 718 modification framework.

- The reduced price allows more shares to be purchased, and these incremental shares need to be accounted for as well. The cost for both these factors is recognized from the modification date through the remaining life of the instrument.

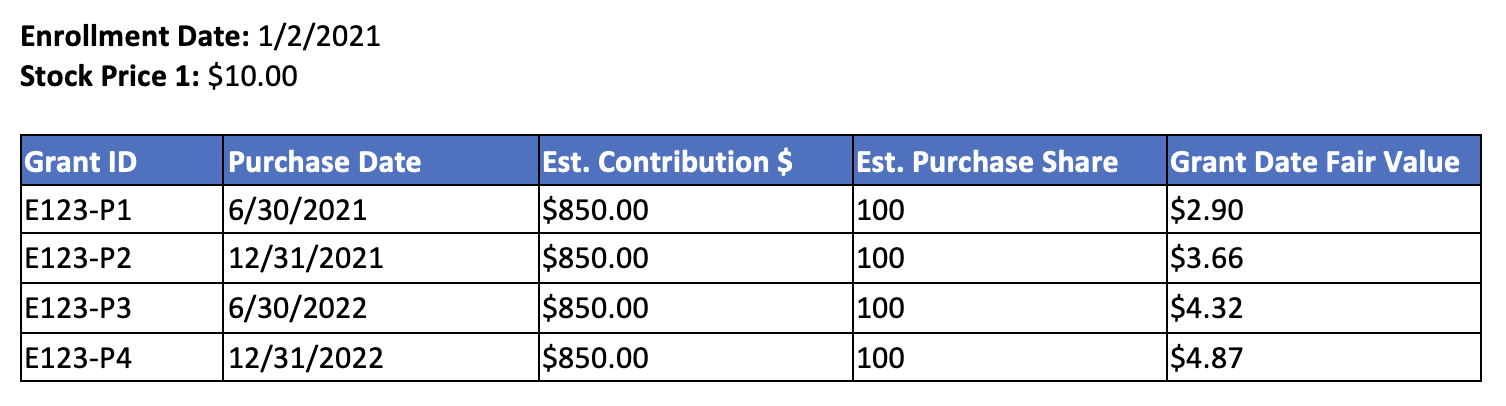

Let’s walk through a simple example of a reset. Assume that on 1/2/2021, Acme Corp. started a two-year offering comprising four six-month purchases, with a stock price of $10 and a 15% discount with a lookback. Consider these enrollment details for a single employee:

Before the reset, the lookback price would have been 85% of the stock price (reflecting the 15% discount), or $8.50. With $850 in estimated contributions, the employee would purchase about 100 shares on each purchase date ($850/$8.50).

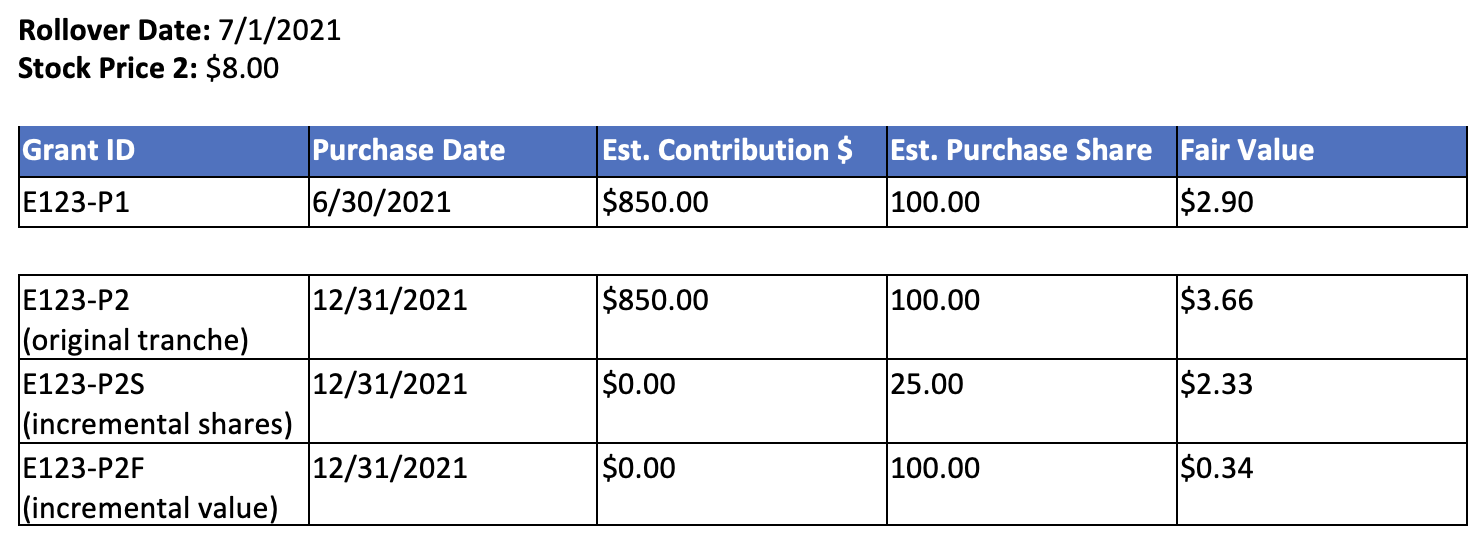

Suppose the stock price is $8 on 6/30/2021 and a reset is triggered. In that case, P1 would have been purchased normally, but P2-P4 would be modified. Let’s look at the modification treatment for P2:

- To calculate the additional shares to be purchased, we take the estimated contributions ($850) and divide by the new, lower lookback price (85% of $8, or $6.80). That gets us about 125 shares to be purchased. Since our original estimate was for 100 shares, this means we estimate 25 incremental shares to be purchased. We often refer to these 25 as a “child award,” as it remains inextricably linked to the original parent award.

- To compute the incremental cost for the original 100 shares, we revalue the ESPP as of 7/1/2021 with the old and new lookback price. The excess value of the latter over the former is the incremental cost. In this example, let’s assume the incremental cost comes out to $0.34 per share.

The final treatment is shown in the table below.

A similar analysis is done for P3 and P4 (since they’re modified in the same way) in order to arrive at the total modification cost.

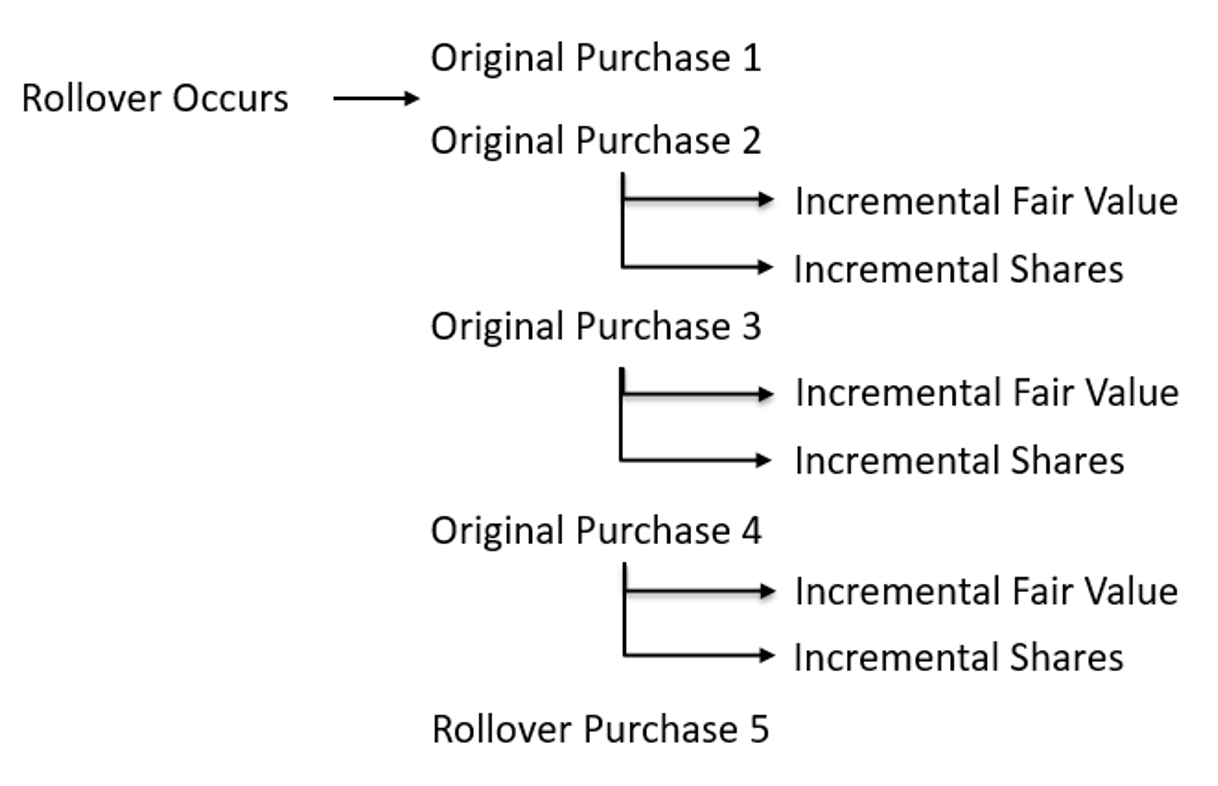

Accounting for Rollovers

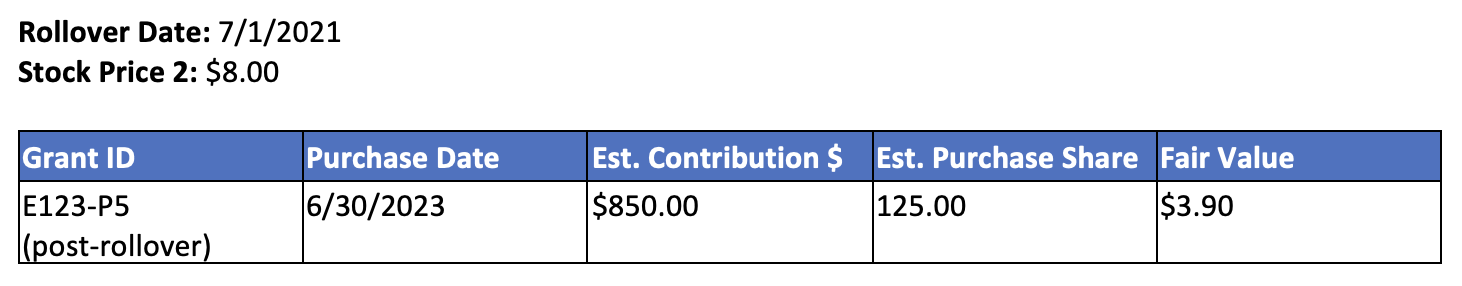

Rollovers contain all of the features of resets, with the additional wrinkle that the participant is enrolled in further purchases on top of having the lowered lookback price. In practice for many companies, this is administratively accomplished by canceling the existing offering after the current purchase and automatically re-enrolling participants in a fresh multi-period offering starting on the modification date. Either way, the accounting framework remains the same. The figure below shows the tranches with incremental cost and the new purchase added.

To determine the impact of the rollover, let’s use our previous example and walk through how the modification would play out. The math for calculating the incremental cost and incremental shares for the child awards is the same. However, we add a new purchase, P5, to the offering. Assuming the original contribution of $850 doesn’t change, we would calculate the estimated shares by taking the estimated contributions divided by the lower discounted purchase price ($6.80) to get 125 shares (see below).

Accounting for Multiple Rollovers

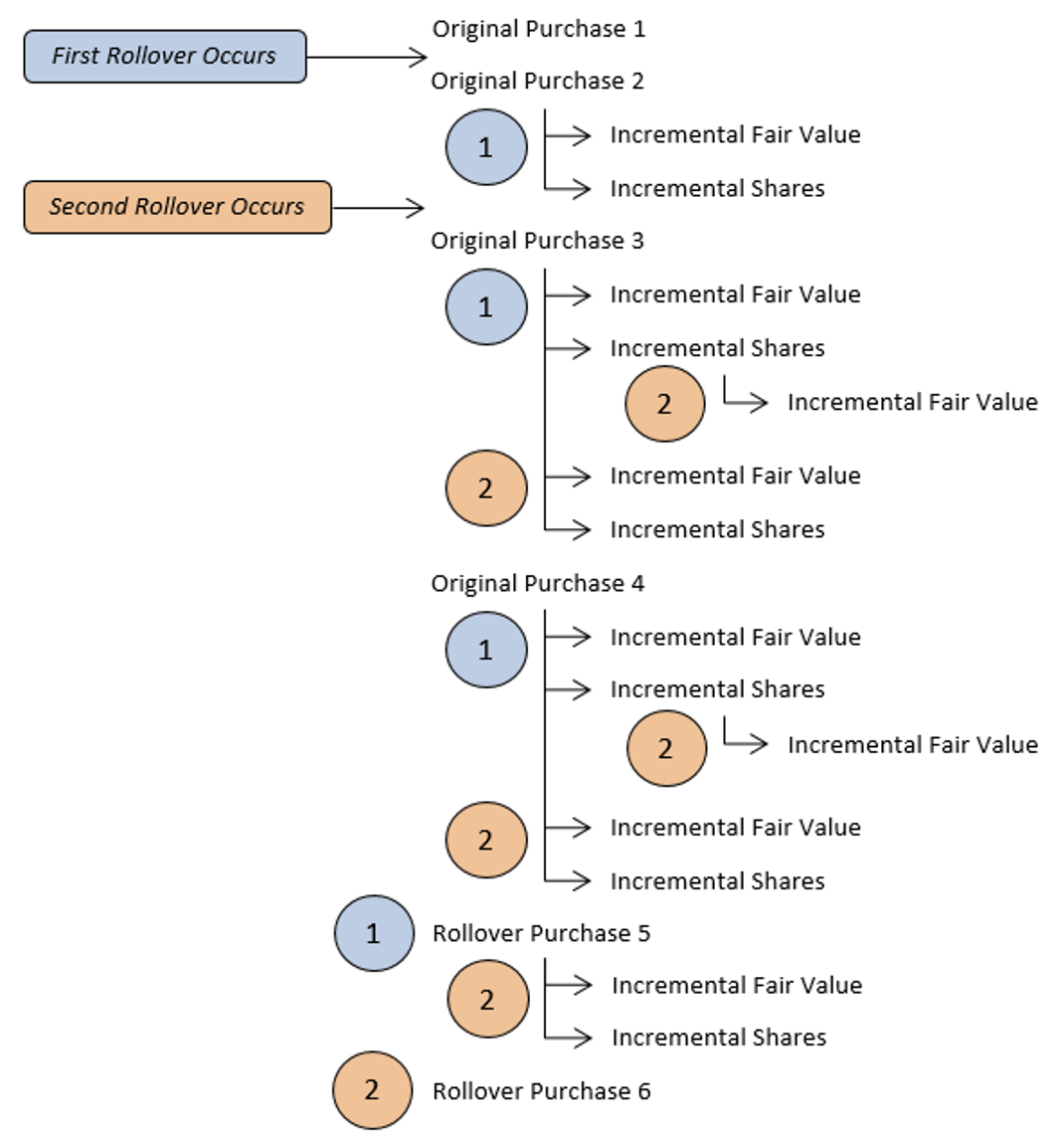

Given the recent uncertainty in the markets, it’s worth considering the possibility of a prolonged period of depressed stock prices and its effects on complex ESPPs. Let’s say a rollover occurs on top of a previously rolled-over offering. This situation is even more complicated because the new rollover modifies everything—including the original estimated purchases, the first set of child awards from the initial rollover, and even the additional rollover purchases. See the diagram below for an illustration.

A situation like this brings more risk into play for both the accounting and stock administration teams. Accounting needs to ensure that the correct treatment is applied at a granular level across multiple horizons. HR needs to ensure employees are in the right enrollments at the right price, and participants are made aware of how their purchasing works. For both groups, a streamlined and automated process is critical to mitigating that risk. While the logic of a basic reset or rollover applies to a complex case, the complex cases are prone to human error or misunderstanding and thus require strong controls.

Accounting for EPS Dilution

One topic deserving special attention is the impact of resets and rollovers on EPS dilution.

As mentioned earlier, when a rollover event occurs, we create two sets of child awards. One is an incremental fair value portion to account for the modification cost. The other is an incremental shares portion to account for the larger number of shares to be purchased given the lower lookback price.

For dilution purposes, the issuable shares means only the shares expected to be released to the employee. This includes the original estimated shares of the parent award plus the incremental shares that can be purchased as a result of the lower stock price. However, the associated fair value component needs to be considered when calculating the unamortized compensation cost component of proceeds under the treasury stock method.

Closing Thoughts

ESPPs remain a cost-effective way to deliver outsized value to employees, even in—maybe especially in—adverse market conditions. However, these conditions give rise to accounting complexities and nuances that can quickly multiply. In these situations, a well-designed automated process is key to accurate reporting and an effective control environment.

Many companies implemented their ESPP during the recent bull market and have been accounting on autopilot without having to deal with these complexities. But the recent downturn may have triggered their first reset or rollover. That means there’s no time like the present to fortify your process against any volatility to come.

If you have any questions about ESPP accounting or design, whether you currently have one or are researching your options, please don’t hesitate to reach out.